According to Mining News Pro - In recent conversation with market participants, SteelMint learned that Pakistan steel market hasn’t observed active buying for imported scrap despite of stability in offer levels. Few buyers booked limited quantity deals at stable prices as per their prompt requirements on low inventories available in hand. However, demand remained low on weak domestic finish steel sales and over the perspective of market closure for religious holidays in next couple of days. Pakistan market is likely to remain close from Thursday to Sunday and may reopen actively on or after 24th Sept’18.

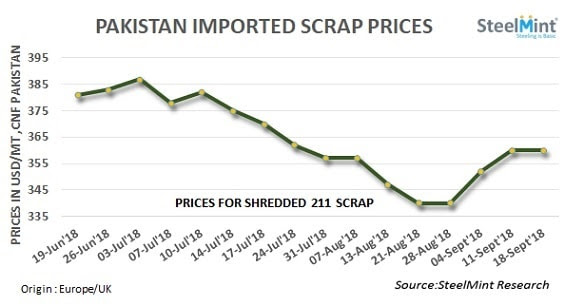

Few deals of containerized Shredded scrap concluded in the range of USD 357-358/MT, CFR Qasim for Europe origin. However, Shredded offers from UK remain at around USD 360/MT, CFR Qasim. USA based recyclers remain less offering and limited offers heard in the range of USD 360-365/MT,CFR stable W-o-W.

HMS 1&2 from South Africa was being offered at around USD 350-353/MT, CFR and HMS 1 from UAE assessed at around USD 353-355/MT, CFR inched up by USD 2-3/MT on W-o-W. HMS 1&2 (80:20) assessed at USD 345-350/MT, CFR depending on origin.

“Even after considerable inquiries being placed for Dubai HMS 1 scrap, suppliers offers remain firm at around USD 355/MT due to lesser availability. This has surprised buyers as suppliers were not offering at cheaper levels and very limited trades concluded ahead of religious holidays for Muharram.” shared a source.

Local steel prices assessed as on 18th Sept’18 –

| Average Prices, Ex-work Punjab and Lahore,inclusive of taxes |

| Particular | 18th Sept`18 | Last week assessment | WoW Change |

| PKR/MT | USD/MT | PKR/MT | PKR |

| Local Scrap (Equivalent to Shredded) | 53,000-53,500 | 430-434 | 53,000-53,500 | 0 |

| Bala (Local Ticket) | 72,500-73,500 | 588-597 | 72,500-73,500 | 0 |

| CC Billet (Grade 60) | 78,500-79,500 | 637-645 | 78,500-79,500 | 0 |

| Deformed bar (G-60) | 94,000-95,000 | 762-770 | 94,000-95,000 | 0 |

Source: SteelMint Research

Local steel market awaits for release of funds from new government - According to sources, market awaits for new plans of government in their mini budget being presented today. Everyone expects for release of funds towards construction projects at earliest. Local steel market in Pakistan remained almost stable and expected to get improved further after Muharram holidays. Sales of local scrap, bala billet and CC billet have increased slightly at stable prices but rebar prices remain to lower side on dull demand.

Local scrap prices remain stable on W-o-W - Local scrap prices in Pakistan learned to have remained stable after last weeks’ rise following global prices. Local scrap remains cheaper over imported by around PKR 1,000-1,500/MT (USD 8-12) depending on the quality and location. Local pure super toke scrap equivalent Shredded is assessed at around PKR 53,000/MT, ex-works. And local HMS scrap assessed at PKR 48,000-49,000/MT, ex-works. Ship cutting steel plate prices in Pakistan assessed at PKR 75,000/MT. Ship breaking market witnessed two sales of tankers at stable prices with indication of resurgence in Gadani’s market.

Pakistan’s mini budget proposes rise in gas prices–According to participants, the proposed increase in average gas prices presented in the mini budget is about 52%, New gas average prices are noted at 716.8 in PKR/MMBTU as against 472.5 earlier. However, petroleum ministry proposes around 40% increase in prices of commercial gas to PKR 980/MMTBU in this mini budget.