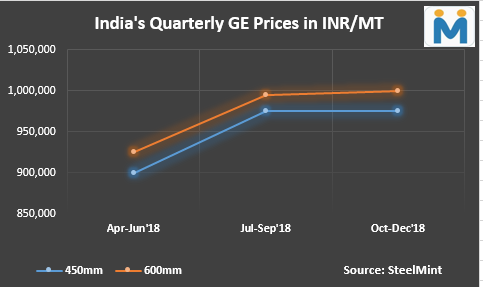

According to Mining News Pro -According to the SteelMint sources, the contract prices of graphite electrodes (GE) in the Indian market for Oct-Dec’18 quarter are heard to remain almost at similar levels against the previous quarter of Jul-Sep’18. The prevailing prices of 450mm HP grade GE are assessed at INR 975,000/MT (USD 13,160/MT) and that of 600mm UHP grade GE are heard at INR 1,000,000/MT (USD 13,500/MT).

The GE prices in India were on a roll since last year due to robust global market conditions. Amid environmental concerns world’s largest steel producing nation China started promoting steel production through less-polluting EAF (Electric arc furnace) route which pushed the demand for graphite electrodes, a key raw material for EAFs and so does its prices.

The country also reduced nearly 300,000 tonnes of graphite electrode manufacturing capacities due to tightening of pollution limit of industrial plants which resulted in closure of about 30% of graphite electrode production in the country, while some restricted their output.

However, over the time the capacity utilisations of GE units in China improved once again after abiding by the set environmental norms, resulting which the electrodes availability in the country increased and so the domestic GE prices which were on a peak last year normalised thus providing stability to graphite electrodes prices of other countries.

Also, last month India has removed anti-dumping duty on GE imports from China resulting which there is limited scope for India`s domestic players to increase their GE prices significantly.

Outlook of GE demand in India

As per the industry experts, the domestic graphite electrodes demand in India is likely to increase amid consolidation in the Indian steel industry where a couple of large steel plants has already been acquired by the existing large steel industry players. These large players are likely to ramp up their production in the immediate future which will push demand for GE.

Also China’s focus on cleaning up the environment continuous to strengthen. The winter clamp down on 82 different steel industry areas is likely to reduce some more environmentally unfriendly steel capacity in China. Furthermore, it has been observed that electric arc furnaces which were earlier constraint to produce certain automobile and other special steel products have also entered the segment due to technological advancement in the electric arc furnace industry. Now these EAF are encroaching upon certain segments of steel which were hitherto to only reserve for the blast furnace sector thereby helping more and more production through EAF in the future. All these augers well for GE industry resulting in strong demand for electrodes in the foreseeable future.

Advantages to the Indian GE players

The Indian GE market is dominated by two key players, HEG Ltd and Graphite India and these two players have been highly benefited with the upheaval in GE industry. In the near future also the demand-supply mismatch in electrode is going in the favour of these two companies as the global GE supply remains in the hands of only a handful of companies in the world and the lead time for any new Greenfield plant capacities to be created is not going to be less than four to five years and on top of that there is growing concern on the limited availability of needle coke - a key raw material for graphite electrodes.

The Indian GE major, HEG Ltd majorly procure its needle coke requirement from U.S. supplier Conco Phillips on semi-annual contract basis, and the contract price of the company for needle coke o for Jul-Dec’18 has been heard between USD 3,000-3,500/MT.

India’s GE exports rise BY 6% in H1 CY18

According to customs data, India’s graphite electrodes exports surged by 6% during Jan to Jun’18 against the corresponding period of previous year and were recorded at 40,906 tonnes.

India exported highest GE to Iran at 5,956 tonnes (a fall of 31.4% y-o-y basis) followed by Saudi Arabia at 5,350 tonnes (an increase of 71.4% y-o-y basis) and Turkey at 4,640 tonnes (a surge of 15% y-o-y basis). India’s graphite electrodes to U.S. and Egypt stood at 3,832 tonnes and 2,812 tonnes respectively.

In 2017, the country exported about 80,447 tonnes of graphite electrodes with highest exports being made to Iran at 13,909 tonnes (percentage share of 17%).

Book your seat today at the International Needle Coke Application Market Summit 2018 - To get unique insights into future market dynamics and network with industry experts. To register, visit china.steelmint.com

http://www.miningnewspro.com/en/News/279114/India: What does Graphite Electrodes New Quarter`s Contract Price Reveal?