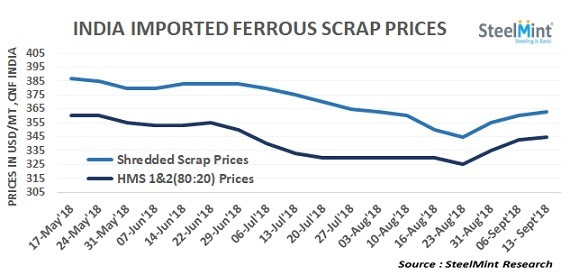

According to Mining News Pro -In recent conversation with market participants, SteelMint learned that Indian scrap importers have observed slight slowdown in scrap bookings majorly affected by sharp currency depreciation this week. With sufficient bookings made in containers in last couple of weeks and after booking bulk cargoes, less deals were reported this week as importers slowed down a bit in the market.

Offers for UK based containerized Shredded heard in the range of USD 360-365/MT, CFR Nhava Sheva with few trades reported at these levels. Less offers from USA suppliers were heard in the market this week. While few trades for European Shredded concluded in the range of USD 357-360/MT, CFR Nhava Sheva.

According to sources, Dubai based suppliers are holding offers in the range of USD 350-355/MT for HMS 1 and South Africa offers remained at around USD 350/MT, CFR. Offers for HMS 1&2 (80:20) heard at USD 340-345/MT from UAE, UK and other origins.

West African HMS in containers of 20-21 MT heard being traded at USD 333-335/MT, CFR Goa and USD 335-340/MT, CFR Nhava Sheva.

Indian sponge iron prices have moved up on tight availability and thus few steelmakers are shifting to its substitute like West African HMS scrap to be mixed with sponge iron for steel-making. Also, currency depreciation remains a concern for Indian importers before making trades.

Indian domestic scrap prices edge up amid improved semis prices - Indian local HMS scrap prices show uptrend in almost all major regions. Prices move up in central region by INR 300/MT W-o-W on high sponge export prices and stand at INR 30,000/MT, ex-Raipur. Currently, HMS 1&2 (80:20) basic prices assessed at INR 27,300-27,400/MT (USD 380-382) up INR 700 W-o-W, ex- Mumbai. At western coastal region prices move up by INR 400-500/MT W-o-W.

The demand from Chennai based importers has increased for imported scrap. Local HMS (80:20) prices assessed at INR 25,800-25,900/MT, up INR 300/MT W-o-W, ex- Chennai.

Ship breaking market remains in ‘Wait and Watch’ mode – Depreciation of Indian Rupee has been a major concern in Indian ship breaking market. On back of declining interest there were no market sales to report. However, average steel plate’s prices assessed at INR 34,300-34,500/MT for (16 mm) up by INR 400-500/MT W-o-W in the Alang market. Ship cutting prices edge down marginally on W-o-W basis and assessed at USD 415/LDT for general dry bulk cargo; at USD 435/LDT for containers and at USD 425/LDT for tankers on CNF India basis respectively.

http://www.miningnewspro.com/en/News/264695/India: Scrap Importers Turn Less Active After Decent Bookings in Last Weeks